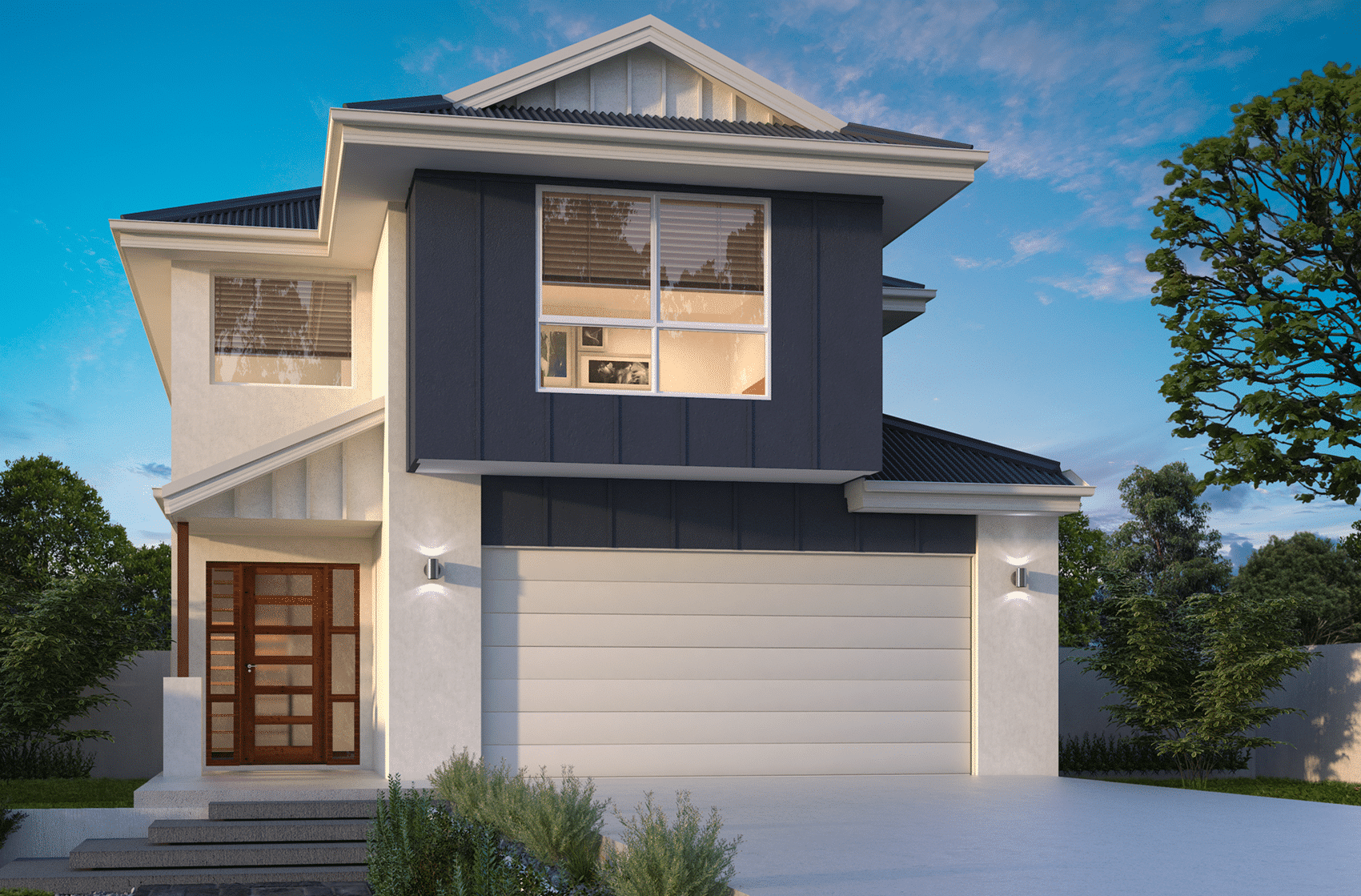

Are You Ready To Build A Property Portfolio?

Building a diverse property portfolio is a great way to invest. If you’re ready to jump in, you will need to decide what is the best possible investment property that will give you the best possible return on your initial investment. Many individuals and couples investing in property rely on the expertise and guidance of our experienced investment property consultants. This may mean you can choose one of our diverse investment property designs in South East Queensland, whilst also still living in your current place of residence. With over 50 years of experience in growing to become one of Queensland’s most reliable Investment Home Builders, GW Homes believes that building your investment portfolio can assist in the following manners;

Cash Flow

Have the ability to control the flow of your cash and potentially investing in a Cash Flow Positive Property solution based in South East Queensland.

Tax Break & Deduction

Investing in property, allows certain concessions and tax breaks which can reduce tax liability.

* Please consult your Tax Professional for clarifications on your individual circumstances.

Appreciation of Value

In South East Queensland and surrounding areas, property prices are on the rise and based off expert research, this is expected to continue into the future.

Superannuation Advantages

Ability in some cases to purchase investment property within your Super Fund, setting you up for success moving into your retirement.

* Please seek advice from your superannuation provider.Understand how to invest in property the GW Homes way. Claim your FREE Property Investing PDF.

Download

Why Choose GW Homes As Your Investment Builder?

If you’re looking to invest in residential property in South East Queensland, you’ll no doubt want to enjoy both long term and short-term gains that is, capital growth in the value of your property and a healthy rental income in the meantime. By choosing to build with GW Homes, that’s exactly what you’ll get. * Subject to market conditions.

Over 50 years building experience

We can assist with getting the right finance for you

Deal with the builder

Lifetime warranty on

all builds

1 year maintenance

warranty

We can help you find the right financial advice for your situation

Fixed price contract with no more to pay

2 year rental

guarantee

Our Most Commonly Asked Questions

Historically it has been shown that residential property has been less volatile than shares.

Yes! 95% of our finished homes are rented within the 14 days leading up to or 14 days after completion of the property. In the unlikely event your property remains vacant after one month The GW Homes Rental Guarantee will pay your rent until your property is tenanted.

Property prices in South East Queensland have risen steadily in the past 20 years*. GW Homes investment properties have been selected in areas that have been master planned with infrastructure that is inviting to families and renters. The more people that want to live in an area, the more the prices will increase over time. *Historical growth is not an indicator of future growth.

If you are fully employed or have owned and operated a business for more than two years, there are tax advantages that could be achieved by owning an investment property. These tax deductions reduce your taxable income and can reduce your monthly cash outgoing, making owning an investment property more affordable each week. Speak to one of our Investment Consultants or your tax professional to find out more.

Residential property is a physical asset that you can touch and visit. Banks will lend up to 95% of the value of a residential property, and if you are fortunate, they may lend up to 60% of the value of your shares. Banks know which is more secure, property.

No specialised knowledge required - Unlike some complex investments, you don't need any particular specialised knowledge to invest in property.

Did you know

GW Homes are proudly offering

GW Homes are proudly offering

Lifetime Structural Guarantee with your new home.

Family Owned Since 1966 We Are GW Homes

With GW Homes’ high quality standards and proven processes, we’ll make sure your home building experience not only meets your expectations, but exceeds them.

We’re proud to be a family-owned, award winning Australian home building company. For more than 50 years, we’ve designed and built innovative, high quality, and original home designs throughout South East Queensland.

GW Homes Advantages

Our family commitment to delivering exceptional quality and service, and long history experience, means you can enjoy a hassle-free building experience.

Our Building Process

From the moment you begin talking to our team, you'll notice the GW Homes difference. We'll take the time to really get to know you, and understand what you're looking for in a home.

Understand how to invest in property with GW Homes way.

Claim your free property investing PDF.

What you need to invest in property?

The majority of property investors use equity they already have in their own home to fund an investment property. It most cases no actual cash is required. You could also consider using your SMSF' (or self-managed superannuation fund) to invest in rental property.

* Please seek advice from your superannuation provider.Examples of investor type homes and inclusions:

Understand how to invest in property the GW Homes way. Claim your FREE Property Investing PDF.

Please input details to download 7 steps property investing